5 questions snowbirds should ask before taking flight

The annual migration may look a little different for Canadian snowbirds this year. Whether you’re undecided about going or are already packing, here are five items you should double check when heading south.

When temperatures drop in late autumn and the first frost appears, thousands of Canadian snowbirds stretch their proverbial wings and begin planning their journey to warmer climates. Unfortunately, Canadians are facing higher costs in almost every aspect of a stay south of the border.

Among other things, inflation has affected the cost of accommodation, flights, food and most consumer goods — an increase that has only been further exacerbated by a higher U.S. dollar.

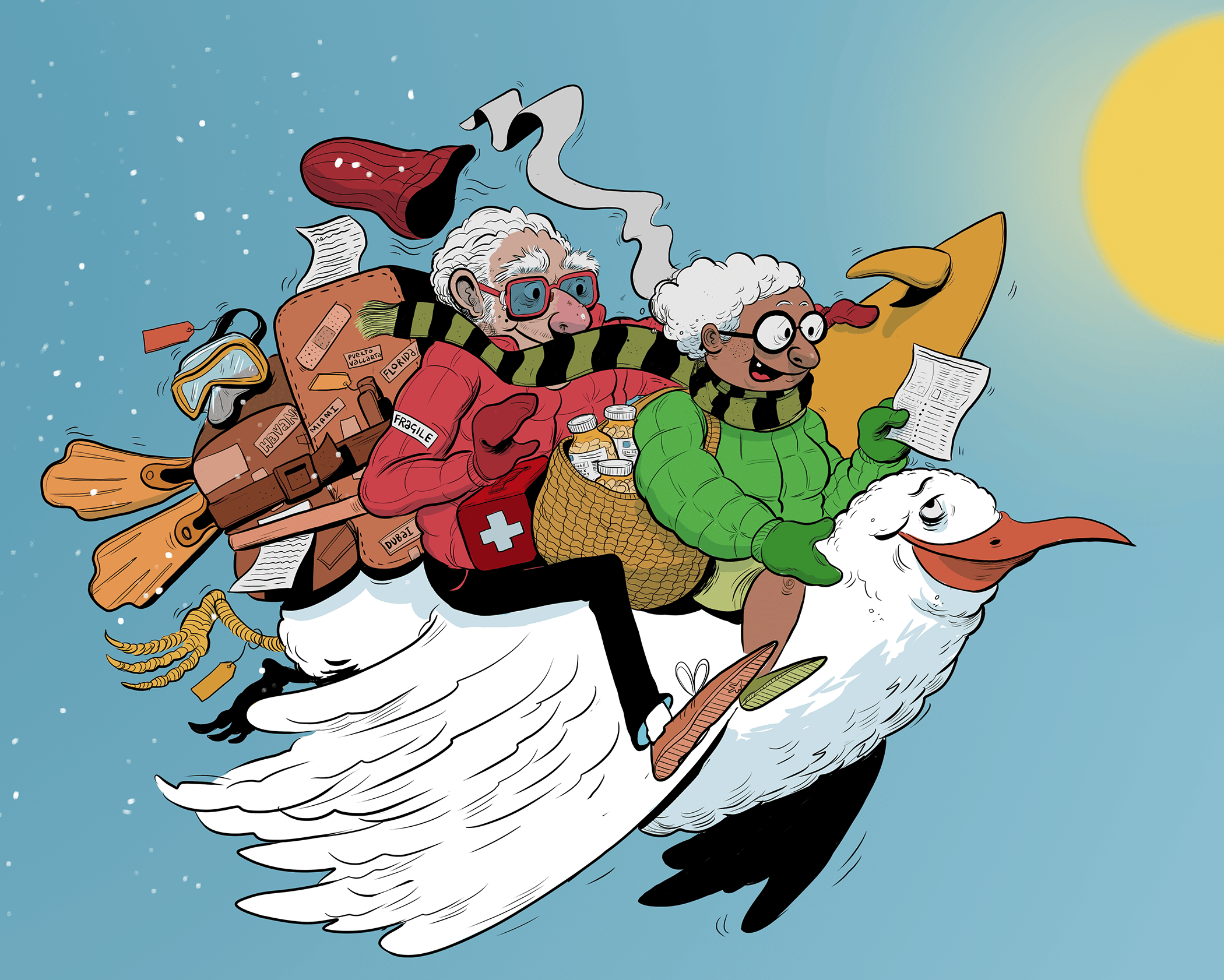

Janet and Adrian are a retired couple who once counted themselves among this group, but since the start of the COVID-19 pandemic, Janet says things just haven’t been the same.

“We were always keen to trade Vancouver’s rainy season for the dry heat of Phoenix, but the pandemic and the rising cost of living changed things,” she says. “Even after the border opened back up, many of the older residents in our close community decided not to return. When we factored in all the changes, plus inflation, we ultimately decided to sell our U.S. property and try something new.”

Although the couple won’t be returning to the desert, Janet says that her sister-in-law still intends to go: “She loves it down there and will probably keep going for years to come.”

Natasha Kovacs, Senior Financial Planner with TD Wealth, says that Janet and Adrian’s experience is quite typical.

“I’ve seen both extremes. I have clients who are very concerned about COVID-19 or inflation and have decided not to go, and I have clients who are the complete opposite. One of them just left for Florida yesterday,” she says.

To those who are still undecided, Kovacs suggests focusing on balance.

“No, the exchange rate is not ideal, and yes, things cost more than they used to, but ultimately, if travel has been a long-term retirement goal of yours, those things don’t have to deter you,” she says.

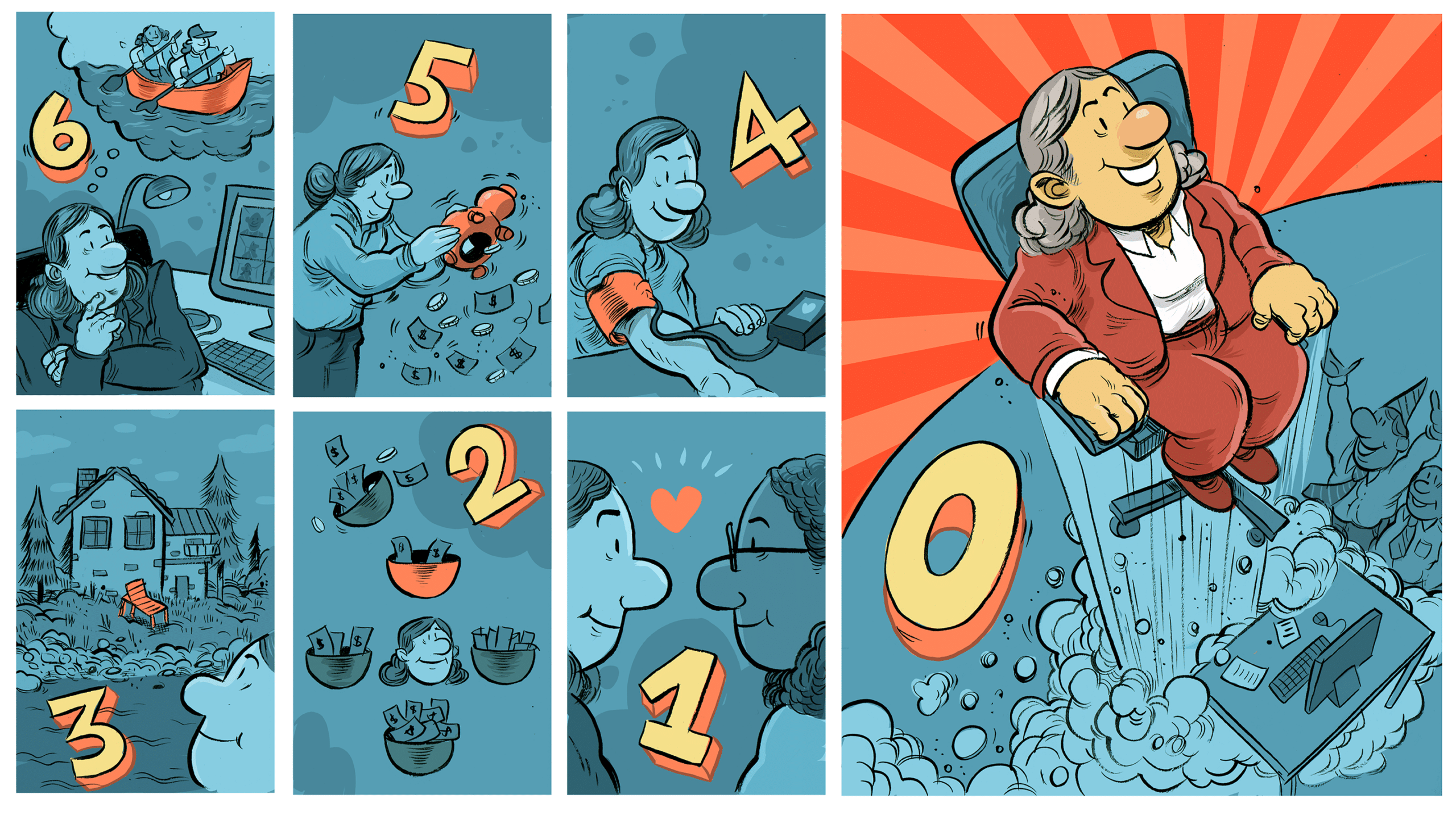

If you’re busy planning your first winter-exodus since 2019, here are five questions you should ask yourself before you start packing your bags.

How should I plan for the increased cost?

In Canada, inflation hit a high of 8.1% in June of 2022, while U.S. inflation was 9.1%. Aggravating the high cost of goods was the weaker position of the loonie compared to the U.S. dollar, pinching affordability for Canadian snowbirds this winter.

“One of my clients goes down to Arizona every year and he told me that the cost of the flight alone has gone up 40%,” says Jocelyn Willoughby, Investment Advisor with TD Wealth.

And it’s not just flights.

“Everything used to be cheaper. As a result, many of my snowbird clients are now more conscientious about spending,” Willoughby says.

To help ensure your spending aligns with your overall financial plan, Nicole Ewing, Director of Tax and Estate Planning with TD Wealth, says your first step should be to speak with your financial advisor or planner.

Sitting down with your advisor and taking a look at your financial plan together can help you understand what you can comfortably afford. In many cases, while you may have the savings necessary, your advisor can help you understand how the added expense might affect your short-term budget or long-term goals, and if any adjustments will need to be made as a result.

How can I save money?

Snowbirds may also want to consider how they will pay for things, and whether or not their chosen method is cost-effective.

For example, it may be beneficial to have a U.S. dollar banking account here in Canada, a U.S. bank account or both. Depending on the type of account, you may be able to avoid hefty wire transfer fees when you need to move money and, in the meantime, you could earn interest on your savings.

“Having some sort of cross-border banking account is generally recommended for the ease of paying U.S. bills directly with U.S. dollars,” Ewing says.

Something else to consider: You may not want to use your regular Canadian credit card for day-to-day purchases when you’re in the U.S. as each transaction can come with a hefty conversion or transaction fee. Instead, many snowbirds choose to use a U.S. dollar credit card that allows them to make purchases in U.S. dollars.

If you’d like to use a cheque to pay for larger expenses, a U.S. bank account can come in handy. That’s because a Canadian cheque typically takes longer to clear through the U.S. banking system than an American one.

To fund a cross-border or U.S. bank account, Kovacs says she often encourages her clients to utilize dollar-cost averaging throughout the year to purchase U.S. dollars. That entails making small, regular purchases of U.S. currency to build your supply, while still minimizing your exposure to large market fluctuations by spreading out the investment.

Kovacs adds that she usually looks to set up a Tax-Free Savings Account for her clients to store any funds that remain in Canada until they’re needed.

Cross-border banking and U.S. bank accounts can get a little complicated and may carry both Canadian and U.S. tax implications. Speak to your advisor if you have any questions.

How long should I stay?

Determining how long you should stay abroad is another important consideration for Canadian snowbirds. In the U.S., there’s a specific formula called the Substantial Presence Test that you’ll need to calculate the length of your stay. Be careful here: Going beyond the set limits can carry tax-related consequences.

“There’s a common misconception that if you’re only in the U.S. 182 days in a year, you’re fine,” Ewing says. “In reality, the U.S. Internal Revenue Agency uses a multiple-year formula.”

Therefore, any time you’ve spent in the U.S. in the previous two years may influence how long you stay this year.

You may be able to apply for an exemption to the Substantial Presence Test if you fulfill the Closer Connection Exemption requirements and complete IRS File Form 8840. However, because the process (and associated paperwork) falls under the jurisdiction of the U.S. legal and tax system, you may want to consult a lawyer.

No matter how long you decide to stay in the U.S. or elsewhere, it’s important to be conscious of the various laws and regulations — both abroad and at home. Not only could you inadvertently trigger foreign tax consequences, but you could also lose your existing health benefits in your home province if you stay too long.

What kind of health care coverage do I need?

Health care is arguably the most important thing you’ll need to consider before you leave Canada. While you can usually expect government-provided health care coverage while you’re on home soil, you will have very little if any coverage for health care abroad unless you purchase it ahead of time. That’s why it’s critical to verify and understand your coverage before you depart.

In addition to ensuring you have adequate health care coverage while you’re away, you should take the time to also check off these other health items: stock up on any important prescriptions you may need (a good rule of thumb is to take a 200-day supply); locate your nearest hospital so you’ll know where to go if there’s an emergency; save a copy of any key health documents you’ll need access to; make sure you hold on to any health care receipts you receive while abroad.

Finally, make a plan to update or obtain your U.S. Powers of Attorney (PoAs). While a variety of Canadian legal documents are valid across our southern border, including your Will, your PoA is not one of them.

Valid PoAs are as important to have when you’re visiting the U.S. as they are back home in Canada. If you become incapacitated, access to funds may be hampered if your Canadian PoA is not recognized as valid at a U.S. bank.

The first step is to find a U.S. lawyer who is familiar with snowbird concerns and situations. This is something Ewing says you should do shortly after you arrive at your final destination.

How can I protect my home while I’m away?

Traveling abroad for the winter can feel like a big undertaking, and a lot of the planning will naturally focus on what might happen once you’re down there. Nonetheless, as Joshua Wiedemann, a Financial Planner with TD Wealth points out, you should also consider what you’re leaving behind.

For example, you may want to shut off the water in your home so your pipes don’t freeze, re-direct your mail, make arrangements for your pets and set up timed lights or security cameras before you leave.

After nearly three years of health restrictions, travel restrictions and staying inside, many Canadian snowbirds are eager to travel once more. And while there are a variety of new things to consider before you book your plane ticket or pack up your car, the basic steps remain more or less the same.

If you have any questions, Ewing suggests reaching out to your advisor: “Your advisor likely has other clients who are in a similar position, and they can let you know what other people are doing and what they recommend.”

While the first trip back south may be a little nerve-wracking, a good plan can usually account for any turbulence.

TAMARA YOUNG

MONEYTALK

ILLUSTRATION

DANESH MOHUIDDIN