A standard understanding of successful Forex traders is far from reality. The media portray them sitting in a penthouse in expensive suits in front of several monitors. When we see such pictures everywhere, it's hard to believe that a successful forex trader looks and behaves like ordinary people.

The article covers the following subjects:

Successful traders in the media

Successful trading results from balancing emotions, desires, work, and leisure time. A successful forex trader finally realizes they don't need most things advertized on beautiful banners even if they can afford them.

Retail Forex traders are OK with one or two monitors and usually work from home. Hedge funds don't need to have an office in a penthouse. One can make profits from online trading in a common building, too.

Who is a Forex trader?

In the general sense of the word, a trader is a person who trades in various assets on a stock exchange: currencies, stocks, bonds, derivatives, and other assets that can be bought and sold.

Forex traders fall into two major categories.

1. Institutional traders

They develop a Forex trading career at a bank or an investment company. They conduct trades on a company's behalf and using its money. At the same time, they can have their own trading strategy and be successful Forex traders. Also, include here traders whose goal is corporate risk hedging and not making a profit. For example, flour producers who buy wheat futures.

An institutional trader conducts a trade at a client's request

2. Retail traders

They trade in the foreign exchange market in their name or on behalf of their own company using their personal funds. A professional retail trader makes money by conducting trades according to their trading strategy. Successful Forex traders can also act as a trustee and manage other investors' capital. Unlike brokers, a trader cannot trade on behalf of third parties.

How does fx market trading work?

Forex trades are subdivided into two categories: directed and undirected trades.

Directed trades aim to profit from an asset's future price changes. For example, you buy the eur/usd at 1.08 and sell it at 1.09 later. Retail traders or investment companies conduct such trades. Directed trades imply opening and closing a trade. For example, you buy the EURUSD and then sell it later at a higher price to speculate on a price change.

Directed trades. Buying at a lower price and selling at a higher price.

Undirected trades aim to buy or sell an asset. Such traders do not think about future price behavior. For example, a tourist from the USA buys the eur/usd because they need euros for their trip across Europe. Or, a Japanese company buys the USDJPY because it has to purchase some US equipment. Such trades mean a person or a company does not aim to speculate.

To start trading Forex, you will need a regulated broker or a bank that offers brokerage services. Traders can use special trading software or place orders remotely by calling their broker.

How do I become a Forex trader?

To start Forex trading, you must choose a broker, open an account and place buy and sell orders through a trading platform. You will need many hours of practice to become a successful Forex trader and turn trading into your main income source. You'll have to develop trading skills and analyze your emotional reactions when trading in the Forex market.

You must register with a broker to open a trading account. Then, you'll have access to your trading stats, accounts, and their parameters, such as leverage, deposit, account type, etc.

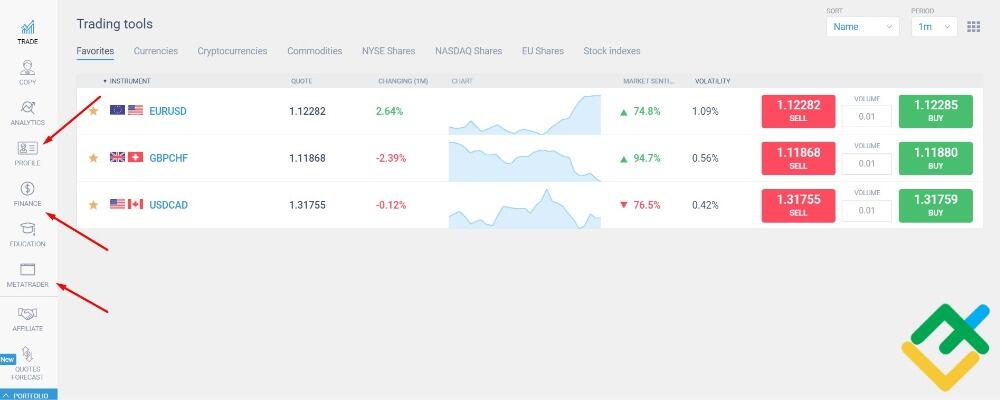

Client personal profile at LiteFinance showing information on the trader, their money, and open accounts

To become successful in Forex trading, you need to open a demo account first. Then, practice using indicators and test trading strategies you may have found. The next part of your trading journey will include two components:

Analysis of statistics, i.e., improving your trading strategy;

Analysis of your emotional reactions and control, i.e., work on system trading where you implicitly follow your trading strategy.

Forex trader success criteria

Success shouldn't be measured in material things you spend your Forex trading income on. It should be estimated in statistical data:

How many trades were conducted in line with your trading strategy?

What is the capital profitability ratio over a given period?

How many months in a year have been profitable?

You can have 95% of system trades but lose all the money in one non-system trade, so the other two indicators will be negative. You can make huge profits, double or treble your risk capital, and have trading losses in the next months. Or, you can have stable monthly profits, but your trading cannot be considered successful if the profit ratio is around zero.

You'll have to improve each of the three indicators to achieve good results. They are like three table legs: all of them are important. The better the three criteria are, the more professional a trader is.

Other success criteria are:

Managed capital;

Track record: how long has a trader been actively trading?

The more capital a Forex trader manages, the more their trading efficiency is as they can earn more with the same profit ratio. Also, a long profit-yielding period means that a trader’s trading program can adapt fast to market conditions, such as volatility and liquidity.

Risk Management and Forex Trading

However much a successful Forex trader may earn, they can lose everything in a single trade — all the profits and the initial investment — unless they place a stop loss!

Risk management is money control amid uncertainty inherent in all financial markets, including Forex. The price can rise or fall, fast or slowly, at any moment. A trader cannot succeed in Forex trading without understanding Forex trading risks.

The main risk management rules:

Observe the rules of your trading system. Deviating from their trading plan, a trader risks worsening their results and missing profits.

Limit the volume of future trades. If a Forex trader uses too much money in a single trade, let's say 5% of the deposit, a series of 5 loss-making trades will decrease their capital by approximately 23% ;

- Trade in liquid assets. The major currency pairs have tight spreads, which attracts fx traders as actual entry and exit levels usually correspond to the projected ones, with some exceptions. The lower liquidity is, the worse entry and exit levels are, which will lower profits and increase losses.

Spread of 2 points, the major currency pair EUR/USD.

So, a trader should:

place stop loss orders to limit losses in advance;

risk no more than 1% of capital per trade, for example;

trade in liquid assets. With intraday trading, it's advisable to trade during an asset's liquid hours.

Ten ways to become successful forex traders

To succeed, you must act systematically, according to the plan, and stick to certain trading rules.

Examine all available Forex trading styles: pipsing, scalping, day trading, swing trading, or position trading. Pick a trading style that suits your temper and fits into your schedule.

Ignore other fx traders' forecasts: no one knows all the reasons for market moves on a price chart. However, some professional traders’ advice can be worth considering.

Don't think about earning a specific amount; think about becoming a good trader.

Try to use various currency pairs and technical analysis tools. Focus on those that yield the best results.

Examine your reactions to unprofitable and profitable trades, correct or incorrect predictions, and missed trading profits. Write down your emotions on paper — all that will help your mind to adapt and increase the percentage of successful system trades.

Examine and test various capital management methods, such as fixed-fractional or fixed-ratio strategies.

Compare your actual trading results only with past performance.

Trade on a Forex platform or tester using virtual funds as long as possible to acquire trading experience and learn faster.

Don't expect fast results. You should have realistic expectations! Specialists need at least four years of training to start a career in any sector. To become a successful trader from scratch, you'll also need time.

Remember two Forex trading postulates: "I'm not the smartest" and "Spare a little for a poor guy." The former means that a person cannot predict market movements. The latter says that you shouldn't seek buying at the low and selling at the high all the time — let the one who entered the market later earn too!

Forex trading risks

The first substantial risk is linked to leverage. The Forex market allows you to operate sums 1,000 times larger than your deposit. Even a successful trader should observe risk management rules, or they can lose the whole capital after one slight price fluctuation.

Still, there always exists the risk of slippage when an order is executed at a worse-than-expected price, even if you trade systematically and respect risk management. That occurs when liquidity falls, and there's no counterparty for your trade at a given price. Thus, a trader risks losing money. Slippages often occur during important news releases when a price moves drastically in opposite directions.

US retail sales statistics and market reaction at the opening of the US trading session

The third risk involved in Forex trading is connected to a trader's mental and emotional state after a series of bad trades, called "tilt." In that state, a trader's decisions are emotional and usually result in inconsistent trading. To handle that, traders are recommended to limit the number of trades a day, a week, or a month and stop trading once that number is reached.

The associated Forex trading risks concern a broker's good faith, Internet connection stability, and the operability of a computer or another device used to trade on Forex.

Key takeaways

Many traders share the same problem: they trade hastily to achieve profits and become successful and disregard trading plans, if they have any. Instead of gaining free trading experience using Forex testers, examining technical indicators, and determining entry/exit points based on a currency pair's peculiarities, a trader gets desperate to earn with minimum initial investment.

As a result, money management and the analysis of risks associated with the technical side of trading, such as slippages or requotes, shift to the background. Hence, larger trading volumes, money losses, and lack of motivation to continue.

In contrast to the popular idea that trading activity is a special trading business, it just requires systematic studies and practice, like any other activity. Consistently profitable trading starts when a trader fully masters their trading system developed in line with their temper, market understanding, emotions, goals, and expectations. Such a transformation needs time.

Questions on how to become a successful Forex trader

You need to read through useless books, try many inefficient anti-scientific strategies, and get disappointed in your trading ability to control emotions a hundred times, but continue moving on. Until you understand what trading is all about and lose interest in "new unique knowledge."

Forex is complex in terms of relations between its participants. So, it's impossible to say which specific event caused this or that price movement. But Forex is simple in its essence: the price will rise if demand exceeds supply; the price will fall if supply exceeds demand.

If approached wisely, that's scalping — short-term intraday trading. Certainly, not pipsing as it's hardly applicable to Forex because of spreads.

Yes, you can. You'll have to work out a profitable trading strategy and become a good trader. But a good strategy won't help if a trader cannot control their emotions or doesn't feel confident.

Such stats do not exist for successful traders as experience levels, deposits, and trading styles vary. Only scalpers can show some daily statistics.

You'll need a few years to master the art of trading. A trader must be pretty intelligent, independent, and able to go on in the bad times. If it's about you, you have a chance.

You must improve your trading strategy on a demo account until the results of 100-200 trades are consistently neutral (about 0) or positive. After that, switch to a real account and trade in minimum volumes in compliance with the risk management rules.

You need talent and a natural leaning to maximum trading achievements. Growing up in favorable conditions is also necessary to become mentally strong. Then you can devote all your free time to developing a talent for trading.

You must gain proper theoretical knowledge about the market's structure. Next, start practicing and pay attention to statistics, not profit amounts. Go step by step and remember to control your mental and emotional state.

Practice makes perfect: pick a convenient strategy, follow it long, collect statistics, and try changing parameters. As a result, you will develop your trading method.

The content of this article reflects the author’s opinion and does not necessarily reflect the official position of LiteFinance. The material published on this page is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.