Canada and its allies are warning that disruptions from attacks on vessels in the Red Sea are “adding significant cost” and delays to global shipping.

A joint statement Wednesday from Canada, the United States, United Kingdom and a host of other nations reiterates condemnation of Houthi attacks on commercial ships in the Red Sea, noting a “significant escalation” over the past week.

“Ongoing Houthi attacks in the Red Sea are illegal, unacceptable, and profoundly destabilizing,” the statement reads.

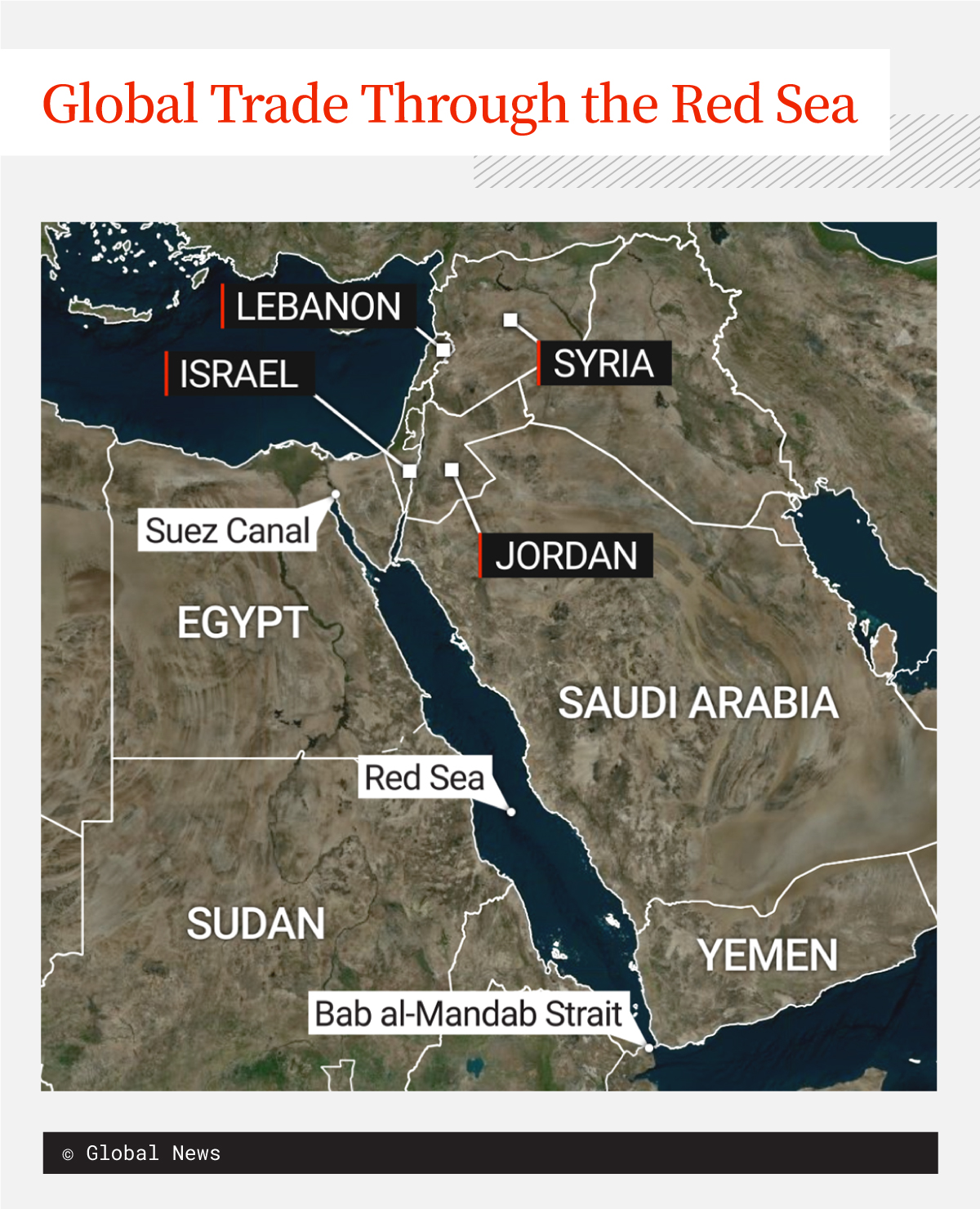

The nations call attacks from the Yemeni-based Houthi a “direct threat to the freedom of navigation” that underpin global trade in “one of the world’s most critical waterways.”

The attacks impact a route vital to East-West trade, especially of oil, as ships use the Red Sea to access the Suez Canal.

In response, some of the world’s largest shipping companies have diverted vessels around southern Africa’s Cape of Good Hope, adding time and costs to voyages.

Denmark-based shipping giant Maersk on Tuesday has reaffirmed it will pause shipping through the Red Sea indefinitely after an attack on one of its ships over the weekend. Germany’s Hapag-Lloyd also said it will avoid the passage until at least Jan. 9, when it will reassess the situation.

Arsenio Dominguez, secretary-general of the International Maritime Association, told the United Nations Security Council during an emergency meeting Wednesday that about 18 shipping companies have begun rerouting vessels around the African continent, adding an additional 10 days to their journeys.

Members of the Security Council, including those who who signed on to the joint statement, also called for the Houthis to halt their attacks, saying they threatened regional stability, global freedom of navigation and food supplies.

The nations’ joint statement released Wednesday says that the Red Sea is responsible for shuttling nearly 15 per cent of global seaborne trade, and that disruptions to the route are driving costs higher for operators.

“International shipping companies continue to reroute their vessels around the Cape of Good Hope, adding significant cost and weeks of delay to the delivery of goods, and ultimately jeopardizing the movement of critical food, fuel, and humanitarian assistance throughout the world,” the statement read.

The nations called for an end to the attacks and seizures in the Red Sea, and said that the Houthis would be held responsible for the consequences of ongoing disruption.

Canada’s Defence Minister Bill Blair echoed the statement in a post on X, the platform formerly known as Twitter.

White House National Security Council spokesperson John Kirby said Wednesday the U.S.-led multinational task force, which includes Canada, has significantly expanded its military presence in the region to counter the attacks — including assets with “offensive and defensive military power.”

“As the president has made clear, the United States does not seek conflict with any nation or actor in the Middle East, nor do we want to see the war between Israel and Hamas widen in the region. But neither will we shrink from the task of defending ourselves, our interests, our partners or the free flow of international commerce,” he said in a press conference.

Kirby said the U.S. economy has yet to feel a significant effect from the Red Sea disturbance, telling reporters it will depend on the length of the disruptions and how “energetic” the Houthi rebels become.

'Knock-on' effects for Canada's economy

While the direct impacts to Canada from disruptions in the Red Sea are limited, experts warn an escalation of conflict in the Middle East has the potential to affect the Canadian economy.

The Bank of Canada’s inflation outlook for 2024 cited broadening overseas conflicts as a key risk in the central banks’ efforts to restore price stability.

“We could see an escalation of war in Europe or the Middle East, or new geopolitical tensions that divert trade and investment and disrupt supply chains,” Bank of Canada governor Tiff Macklem said in a year-end speech highlighting inflation risks heading into 2024.

Patrick Gill, a senior director at the Canadian Chamber of Commerce, told Global News on Wednesday that while Canada operates few commercial vessels of its own in the Red Sea, the “interconnected nature” of global supply chains means there will be a “knock-on” effect from the disruptions for Canadian businesses and their customers.

“This creates a domino effect in the supply chain and causes an increase in the final price of products in Canada,” Gill said in an interview.

“I would say that this is exactly the sort of risk the Bank of Canada cited for 2024.”

The Retail Council of Canada, which represents major grocers other large retailers across the country, is monitoring the Red Sea situation closely, according to spokesperson Michelle Wasylyshen.

“While it is not having an immediate impact on our sector in Canada, it may if the situation continues, and if it affects other transportation routes in the future,” she told Global News in a statement Wednesday.

Disruptions in the Red Sea are not likely to leave grocery shelves bare in Canada, University of Guelph food economist Michael von Massow told Global News in late December. While the Red Sea acts as a critical corridor for food transportation for surrounding countries and European markets, little of what food passes through the region is destined for Canada, he said at the time.

But Canadians could pay more at the grocery store if oil prices push higher because of the conflict, von Massow warned, as transportation costs rise at a time when grocers are relying on imported food.

Oil prices climbed higher on Wednesday, with Reuters citing both Houthi attacks in the Red Sea and a production shutdown at a Libyan oilfield.

Gill said he sees “a lot of parallels” to the 2021 crisis that saw the Ever Given ship run aground in the Suez Canal for nearly a week, stymying worldwide trade. That global supply chain snag saw hundreds of ships queued in the region and experts warned of trade backlogs affecting prices and product availability in Canada.

While it’s a “little early” to say whether Red Sea impacts will be as stark for Canadian consumers, Gill noted that the uncertainty comes as Canadians are already reining in spending after years of elevated inflation and higher interest rates. A further inflationary shock could see consumers claw back even further, deepening the projected downturn in a Canadian economy that’s already struggling to grow.

“Any further price increases in 2024 will continue to dampen and temper Canadian consumer behaviour next year, which will again further slow the Canadian economy even more,” he said.

— with files from Global News’s Anne Gaviola, Sean Boynton and Reuters

Comments